Takepayments competitive contracts with good terminal

Takepayments is a popular merchant service provider in the UK, with a monthly rolling or 18-month contract. Regardless of your choice of plan, Takepayments is most beneficial with a monthly card turnover of at least £2,000.

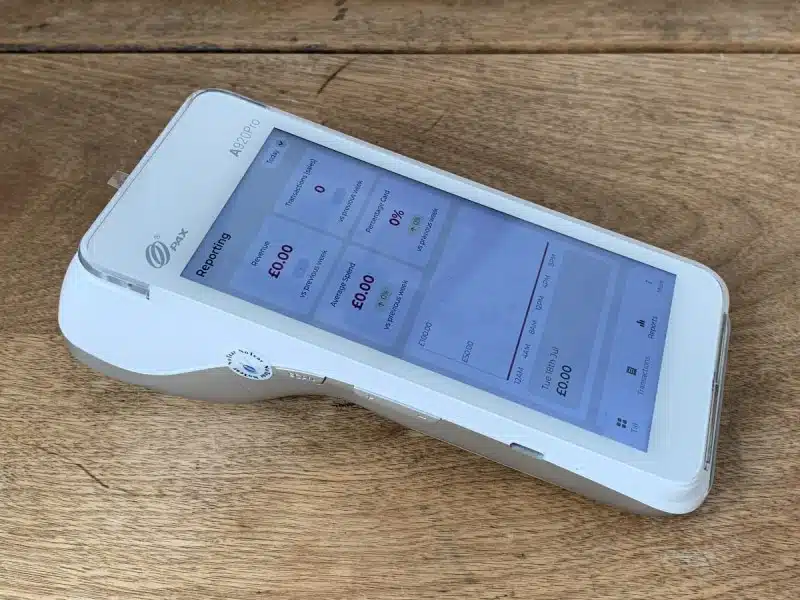

The most popular plan, Takepaymentsplus, includes the smart POS terminal PAX A920Pro with a large touchscreen, tactile sticker (for the visually impaired) and built-in SIM card with mobile data.

It has a complete – and easy to use, in our tests – till app that’s ideal as a mobile checkout, with the ability to add a product library and monitor sales by staff members. The package costs £25 + VAT per month and has an 18 months’ contract.

For £7.50 + VAT monthly (Easy Deal) and a £150 + VAT one-off charge, you only get basic payment software on the same terminal so you can accept cards. This doesn’t have a minimum monthly service charge, includes PCI compliance, and only has a contract of 30 days that is cancellable any time with a month’s notice.

If you want a different high-end card machine, Takepayments offers the Ingenico DX8000 terminal that’s black and also has a large touchscreen. We find this better for dirty environments, as marks and stains won’t show easily on its dark exterior.

Transaction fees depend on your average transaction value, turnover and cards accepted, ranging between 0.3%-2.5% + a flat fee. The quoted rates are better if your business usually accepts high transaction values. Fees for refunds and chargebacks also apply.

On an annual plan, we were given the following extra fees.

Firstly, an early cancellation fee equivalent to buying out the contract applies if you do not give an exit notice of two months during the initial term. If you make less than an agreed amount during a month, there’s also a monthly minimum service charge. Monthly or annual fees for PCI-DSS compliance apply.

Takepayments actually signs you up for two contracts – one for themselves and one for Barclaycard Business who provides your merchant account for card processing. Next-day settlement with Barclaycard is free.

For an additional cost, remote payments can be added, such as pay by link, telephone payments, QR codes for table-service, and an online payment gateway for ecommerce. For more extensive POS features, you can opt for a tPOS package with a touchscreen register and EPOS software tailored to your industry.

Signing up requires talking to a Takepayments sales rep, most likely in connection with a physical visit to your premises. After onboarding, you have access to customer support over the phone every day within working hours.